Small business funding and property: have you considered an SSAS pension?

An SSAS pension (Small Self-Administered Scheme) is an occupational pension plan that is designed for business owners. It not only benefits them when it comes to covering the cost of everyday and long-term expenses, but it’s also a brilliant resource for obtaining commercial property. For some, this is simply a way to improve their property portfolio, but for others, it can be essential for the expansion and success of their small business.

In an era when SMEs and startups are an ever-present and vital part of the modern business world, more and more people are striving to become their own boss. There are several different aspects to consider when it comes to establishing and running a company, but this will not be possible if you lack sufficient funding.

In this post, we’ll discuss the usefulness of SSAS pension plans with regards to funding and maintaining your business.

What is an SSAS pension fund?

If you’re in need of an alternative way to fund or support your company, an SSAS pension might just be the solution you’ve been looking for. In most cases, business owners will look to bank loans, crowdfunding or pooling investors to fund their ventures, but they often neglect the usefulness of an occupational pension fund.

SSAS pensions are designed for professionals who need a pension that supports their business or startup by allowing them to freely move funds between their business and pension while benefiting from corporation tax relief. If you require additional funds to expand your company or cover larger expenses (such as property), you can withdraw tax-free funds from your pension. Alternatively, you can take money from your company and invest it into your pension fund for future use.

What are the benefits of an SSAS pension?

When you hear the term “pension”, it’s natural to assume that it relates to finances that will be used later on down the road when you retire, but an SSAS pension is very useful for the here and now. For modern company owners, an occupational pension can be a vital business tool, as it provides flexible funding at a moment’s notice, rather than you having to jump through hoops for a loan or take the time to raise the funds.

First and foremost, having additional funds when you need it can prove to be highly beneficial for day-to-day business costs, but for companies that are looking to grow and further establish their brand, it also provides the necessary capital to do so successfully. For those who are looking to expand in a more literal sense, purchasing a larger property can provide businesses with a vast range of benefits.

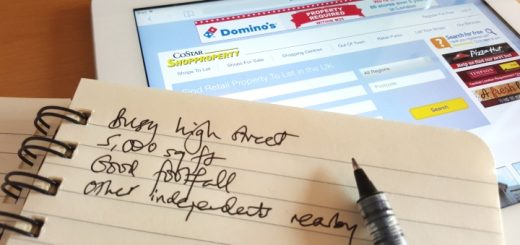

Investing in property

When purchased using a pension, “commercial property” tends to have a broad meaning and can include anything from high-street premises or land for development to factories, hotels, car parks, pubs and much more. This means that a property pension can be used by company directors in pretty much any industry you can think of. However, the property they invest in doesn’t have to be industry specific, meaning that they could use their funds to branch out into new sectors.

If you’re a small business owner looking for an additional form of income that requires little to no effort, renting property to a third party is an ideal way to achieve it. You can withdraw the necessary funds from your pension plan when you need it and once you make a profit, you’ll be able to invest some money back into your pension for future use.